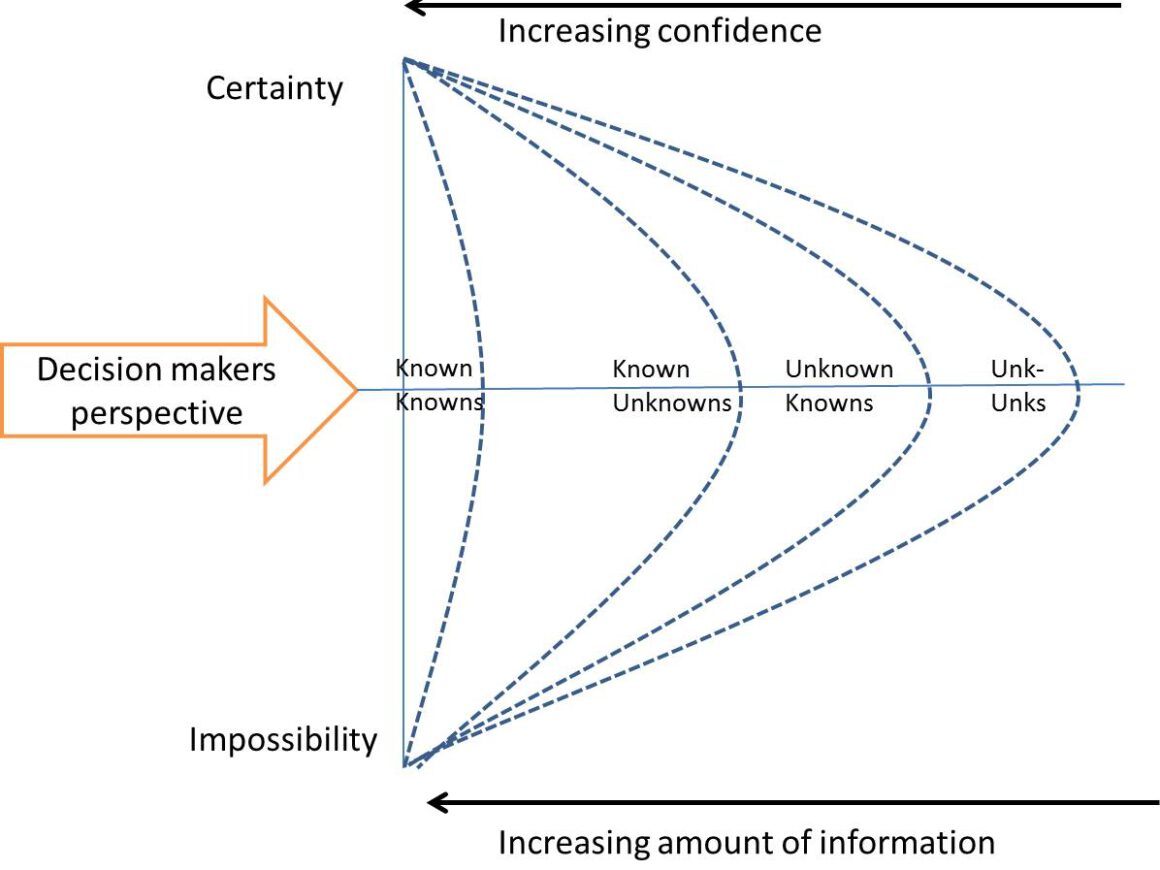

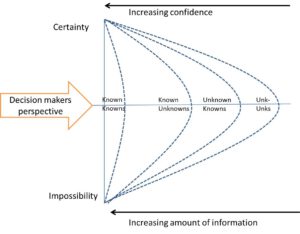

The drawing represents the cognitive model Graham Winch uses to explain the difference between risk, and uncertainty of projects (Winch 2010 p. 349). His explanation of the graph is sophisticated. What I will do in this post is try to make sense of it using my own words. Maybe it will help my students study the literature.

The drawing represents the cognitive model Graham Winch uses to explain the difference between risk, and uncertainty of projects (Winch 2010 p. 349). His explanation of the graph is sophisticated. What I will do in this post is try to make sense of it using my own words. Maybe it will help my students study the literature.

It is very good to visualize systems or concepts as Graham Winch does but I do not fully understand the parabolic dotted lines in this one. Maybe you could say the “known or unk” exists somewhere between impossibility and certainty. Maybe you could make a different drawing telling the same. Nevertheless, let us try to grasp it. First the perspective. The perspective is from the viewpoint of the decision maker. And the decision maker could be you the manager. The known or unk is the possible future incident that could happen (with certainty) or not happen at all (impossibility). Somewhere in between lies reality. If there is sufficient information available to the manager he/she could be able to objectively predict when a certain incident could happen and estimate or define its impact. Then we have a Known Known, represented on the left side of the model. It is called a risk because the incident is definable, and the risk source and the effects are known. Monteiro de Carvalho and Rabechini (2014) define risk as an event subject to a known probability. The manager has the information needed and is confident he/she takes the right decision(s) to deal with it and proceed with a course of action.

In reality, data and future conditions are hardly ever fully known, especially in projects in the construction industry. Especially in the front end of projects or during design. This is maybe why the known-known parabolic line is slightly bent and not straight. Even if there is an abundance of information available the context could easily change or there is still some hidden information. Maybe the information is unveiled later in the process. If we move more to the right side of the graph, less information is available and uncertainty grows. Unknowns start to come into play. More to the right, we have to deal – according to Winch – with uncertainties and not with risks. This is funny to me because we mainly talk about risk instead of uncertainty. He explains that a possible incident is uncertain when it is not entirely definable and information is missing. Uncertainties can be partly defined or not at all because we do not know them fully.

It feels like a semantic discussion and a bit of playing with words.

A manager will have to make decisions when solving situations. He/she makes sense of the information available and he/she will judge and decide based on risk, an event subject to a known probability., even if not all information is available. Does he/she value the event as a risk or as uncertainty and will that influence his/her behavior? What if you are a risk seeker, risk-neutral, or risk averse? That will influence your perception and the way you will act.

According to Winch, the cognitive model differs from other risk management approaches in two ways: first, it makes explicit what is often implicit. Dealing with risks or uncertainties is fundamentally a function of our perceptions. A risk is not something out there but dependent on the information available and the decisions made. One manager could perceive something as a risk while the other could see it as uncertainty to deal with. Second, the model makes visible the difference between, risk and uncertainty. It is a risk when probability and impact are definable. Uncertainty comes into play as the probability of an incident and or the impact of the incident cannot be defined or completely defined.

Let us reason about the four distinctions he makes.

Known-Knowns is the cognitive (what you know about it) condition of risk: the risk source is defined, and the probability is assigned. That means if the incident occurs in the future we are reasonably confident about the impact and the ways to deal with it. You could assume the manager to take all measures to avoid the thing to happen.

Known-Unknowns. Is the cognitive condition of uncertainty where the source can be defined but the probability or impact not. For instance the condition of the subsoil of a plot of land. We know that most subsoil in Amsterdam is contaminated but where the contamination is precisely or how bad it is, is often not known. Research will be needed to uncover the size and location of possible pollution. Another example we know is that a schedule is only a representation of the future and we know the future will be different than expected. But what and when things will happen is unknown.

Unknown-Knowns. When someone knows about a risk source but holds the information private and does not share it with the team, the client, or the manager. An example could be what we call strategic misrepresentation. We discussed information asymmetry in the first week of the course and the related tensions around the principal-agent problem.

Unknowns-unknowns (unk-unks). It is the cognitive condition of uncertainty where the risk source has not been identified and the risk event, therefore, cannot be known. This phenomenon is called a Black Swan.

Remarkably, Winch states that known knowns are the area of most contention. Remarkable because I thought: if the risk is known then act! If you know what to do what is the risk? But because reality is often different and contexts change, not all data is always available, and the decisions made are based on our perceptions. That means decisions are often (very) subjective and therefore subject to dispute. Maybe pessimistic project managers think more about risks and not about uncertainties, placing an event in the known-known sphere leads to making a wrong decision and acting the wrong way. Taking a step back and looking at the event from a different angle could change your mind and you see that the incident is an uncertainty.

Now I wonder why we do not call the whole thing uncertainty management. To me, the concept of risk management is confusing and has a to negative connotation. Let us call it dealing with uncertainties and half of the problem is solved using a different narrative.