During our DCM course we will discuss the difference between asset and artefact related to real estate. Real estate as an artefact is considered as a useful thing to support an important ?goal in life?. The building of a museum will be valued an artefact by its organisation because the building makes it possible to present art to the public in a safe environment. You cannot show most art outside, so you need the building to exhibit. In the same way shops need buildings to sell stuff, industry need buildings to manufacture and schools need them to be able to educate.

During our DCM course we will discuss the difference between asset and artefact related to real estate. Real estate as an artefact is considered as a useful thing to support an important ?goal in life?. The building of a museum will be valued an artefact by its organisation because the building makes it possible to present art to the public in a safe environment. You cannot show most art outside, so you need the building to exhibit. In the same way shops need buildings to sell stuff, industry need buildings to manufacture and schools need them to be able to educate.

Buildings are assets as well. An asset is primary an economic resource. ?Anything tangible or intangible that is capable of being owned or controlled to produce value and that is held to have positive economic value is considered an asset.? Simply stated, assets represent value of ownership that can be converted into cash. Real estate is an important part of the economy and besides stocks, shares, commodities or treasury bonds a way to invest.

Artefacts serve the organisation using the building, assets serve the owner for financial profit.

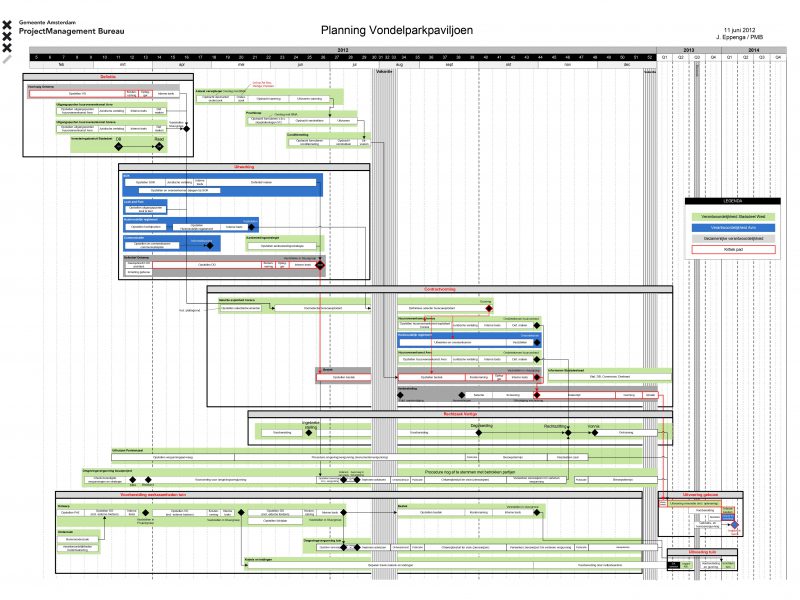

The attitude towards a building, form these two perspectives, will be totally different. In the case of Vondelpark pavilion the owner values the building as something to rent out. He looks to the building as an asset. But the AVRO, the tenant, a broadcasting foundation, values the building as the place to perform, to act, to ?do culture?, to do business, to invite people, to add cultural value to society. In the case of the pavilion the building is valued in two ways depending on the organisation.

It is possible to turn artefacts into assets. It is called ?sale and lease back?. This can be part of a company?s strategy or a way to get cash. Selling a building can be very profitable on a short term but leasing it back can be costly over time.

During my holiday in Greece this summer, I read about the Troika; the international team of financiers and controllers implementing austerity over the Greeks.

One of the ways to generate cash on the short term is to sell property. The plan is to earn 50 billion cash by selling state property to the market. For instance harbours and highways.

To do so a special corporation is set up: the Hellenic Republic Asset Development Fund. (HRADF). This fund already bought 28 state office buildings and the plan is to buy the Parthenon too.

The contract is simple. The 28 buildings are sold for 261 million euros in a lease contract and rented back by the government for 30 million a year. The lease contract lasts 20 years generating about 600 million over time for the fund.

By turning artefacts into assets the Greek state generates income to pay off depth, but it loses 338 million over time (20 years) to the fund. Seems a good investment for the fund and a great loss for Greek society in the long run.